31

March 2024

Investment Management Online Funds’ performance for the quarter ended 31 March 2024

Adriaan Pask

Chief Investment Officer,PSG Wealth

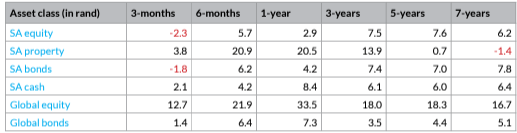

Despite a boost from resource counters in March, South African equities ended the quarter in negative territory -2.30% q/q as the domestic economy disappointed. Industrials +0.90% q/q) and listed property +3.80% q/q added the most value overall, while other key sectors such as financials -7.10% q/q lagged. Meanwhile, local fixed income markets saw broad losses, with the short end of the curve the only bright spot over the quarter (+0.8% QoQ). Offshore, developed market equities +12.70% q/q strengthened on the back of positive sentiment, with the artificial intelligence (AI) theme continuing to drive growth stock performance.

Sources: Morningstar Direct, PSG Wealth research team

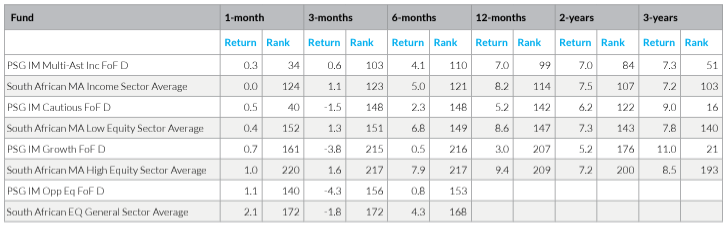

The three domestic multi-asset funds of funds experienced a tough quarter, as domestic growth and fixed income assets came under pressure. The solutions have remained top-quartile performers in their respective sectors since inception.

PSG IM domestic funds

The three domestic multi-asset solutions delivered positive absolute returns over the three months ended 31 March 2024 despite a tough quarter for domestic assets. Allocations to money market instruments and corporate bonds buoyed the fixed income building block, providing support as domestic government bonds detracted from returns. The equity component detracted from returns following a tough quarter for domestic equities. Stock selection within real estate was a positive contributor to absolute performance. Sun International, AECI and Discovery were among the largest detractors from returns, while AngloGold Ashanti, Raubex and AVI helped limit losses. The PSG IM Opportunity Equity Fund of Funds also experienced a tough quarter as domestic equities faltered, with our underlying managers’ preference for SA Inc shares detracting from performance on both an absolute and a relative basis. Overall, they continue to see opportunities domestically, citing attractive valuations and a preference for businesses with robust balance sheets in their security selection.

Source: PSG Wealth research team

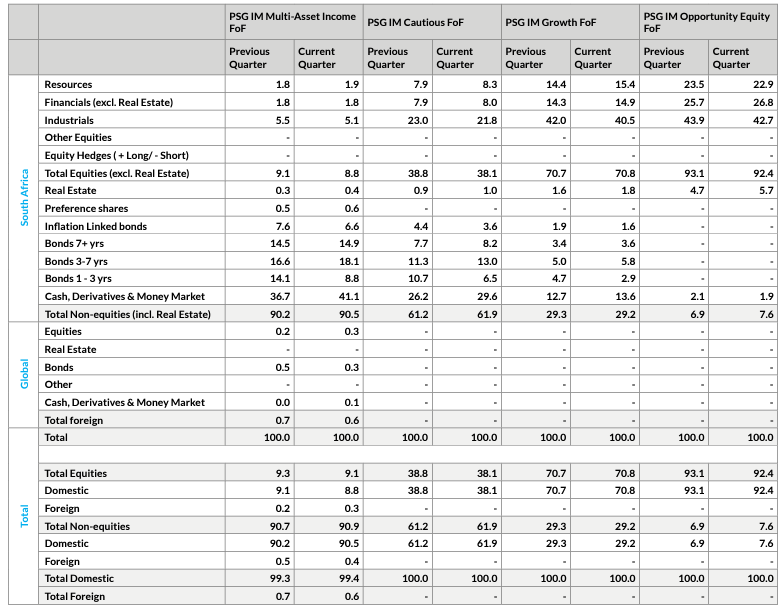

Sector and asset allocation

No changes were made to the underlying funds used in the domestic solutions. In the PSG IM MA Income FoF, our underlying fixed income managers continued to extend duration, trimming exposure to the shorter end of the curve. Allocations to offshore bonds ticked lower quarter on quarter, at the expense of offshore cash. The portfolio generated an absolute return over the quarter and has continued to outperform peers since inception.

The equity building block used in both the Cautious and Growth FoFs detracted from absolute returns, as security selection within industrials and financials detracted the most from returns. AECI, Remgro and Discovery were among the largest detractors from performance. Selected resource and construction counters helped mute losses, with AngloGold, WBHO, Raubex and Anglo American adding value over the quarter. Despite the tough quarter, the Cautious and Growth FoFs have continued to outperform relative to peers over their respective recommended minimum holding periods and since inception.

The underlying managers in the Opportunity Equity FoF continue to favour domestic industrials and financials given attractive valuations of their opportunity sets. Allocations to domestic real estate ticked higher as the sector added value over the quarter. Despite a positive March for the underlying funds, the solution ended the quarter in the negative in absolute terms following a negative January and February for the underlying managers used in the portfolio. All Weather was the top performer over the quarter, while Perpetua detracted the most.

PSG IM MA Income FoF has maintained its top-quartile position in the ASISA MA Income category since inception, with positive absolute returns over the past quarter building on its longterm track record.

The PSG IM Cautious FoF continues to reward investors over its recommended holding period.

A positive March helped the PSG IM Growth FoF continue to add value over the long term.

Source: PSG Wealth research team

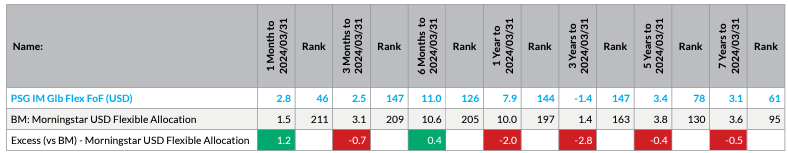

PSG IM Global Flexible Dollar Fund

The PSG IM Global Flexible FoF (USD) had a slower 3-month return trailing the sector by 0.7%. However, it still delivered a positive absolute return of 2.5%. Looking to the longer term, the performance remains more resilient through a full market cycle given the return generated by the fund over its 7-year recommended holding period. Over the quarter, Ninety One Global Macro Allocation Fund was the biggest detractor from fund performance – mainly due to its developed market bond exposure as yields remain higher for longer, a view not commonly held by the market coming into this year. The fund has seen an increase in equity exposure, allocating to US, Chinese, South Korean and Taiwanese equities. Hedges are held on European equities; however, these were trimmed in favour of higher equity allocations overall. Veritas Global Real Return Fund was the top performer over the quarter, as they managed their short positions and harnessed alpha as equities rallied. Over the quarter, the PSG Global Flexible Fund, a value manager, was added to the solution. The fund’s role will be to add alpha through its differentiated security selection relative to incumbent underlying managers, guided by the fund manager’s focus on evaluating a company’s 3Ms (moat, management and margin of safety). Following this addition, we believe the solution is better positioned to add value over its recommended holding period.

The PSG IM Global Flexible Dollar Fund added value in absolute terms over the quarter.

Source: Morningstar Direct